Blog

Inflation, Cost of Living, Unemployment and Economic Development

By Kelly Murphy-Redd

These days it seems that nearly everyone has an opinion about the state of our nation’s economy, and the subject of inflation is at the forefront of these debates. The administration tells us there is no inflation. On the other hand the Federal Reserve says it’s just temporary. It does make you wonder how both can be true.

The simple definition of inflation is prices of goods rising over time and the value of currency declining. It takes more money to buy what we need. Some spend instead of saving because they know their money will buy less and earn less in the future. Many refer to inflation as a hidden tax. The middle class and the poor are affected the most of course. Those on fixed incomes really suffer.

The Federalist explains inflation is calculated by using the “Consumer Price Index, a mathematical tool that measures the prices change for a selected basket of goods and services.”

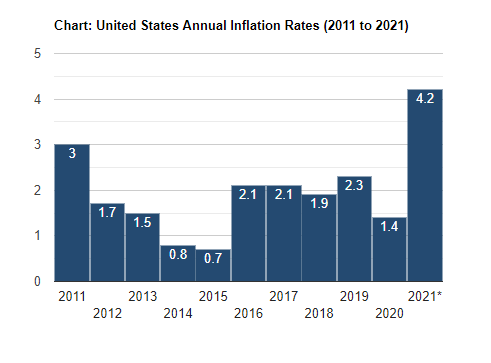

Economists say some inflation is good for the economy. They like it at approximately 2%.

Source: usinflationcalculator.com

CNN Business reported recently, “prices for finished goods increased by the largest amount since the government started tracking that specific measure in 2009. The biggest driver was a sharp 8.8% jump in gasoline prices.”

Fortune is one of many outlets reporting lumber prices rising 280%! That means it costs more to build a house. Less people can afford to build the same house they might have afforded a year ago. Housing values rising and low inventory, has resulted in a seller’s market.

Economists explain that if the Federal Reserve decides to increase the money supply, commonly called printing money, and the supply of goods does not increase, then prices will go up. People have more cash but there are not enough goods to buy.

Kelly Murphy Redd, CEcD, Murphy Redd Marketing